The term ACH stands for Automatic Clearing House -- which is associated with settling Account balances to Checking Accounts electronically.

Description: How ACH Works

This subsystem provides a means of Members to give the Club permission to submit their Statement Balances for Checking Account approval (typically once a month).

The setups for Abacus 21's ACH System will provide for the definition of each Member-Client's Routing Number, Account Number, and declaration regarding Checking or Savings Account.

Abacus 21's ACH System will allow for submission on a specific day/date (in the month following the live transactions into A/R) -- creating a batch file of outstanding balances of all Members-Clients who have agreed to this method of payment (providing for the ABA Company ID, Bank and State, and Transaction Description to appear on the Member Statement).

Depending on the Club’s policies and preferences, the ACH process is typically run before Statements are printed; in some Client deployments it is run a certain number of days before/after Statements are sent out. This batch process goes through the Membership files looking for Members who have ACH activated (this is triggered by have appropriate Member Checking Account information on file), and the Abacus 21 system has the capability of segregating certain types of charges to be included/excluded as well as being routed to different Credit Cards and who have an outstanding account balance. This creates a ACH Batch authorization request submission export file – one that complies with the NACHA standards.

Simultaneously, this process creates a Cash Receipts Entry Batch – (typically) assuming all submissions will be viewed, approved, and posted.

Statements are then available to send out -- reflecting the results of the ACH submission applications. Corrections or adjustments have to be made with A/R Debit Memos or (negative) Cash Receipts.

Depending on the Bank's ability to electronically respond with approval-denial information this is either a one-way or two-way interaction.

In a one-way scenario, the submission of Checking Account Approval posting batch assumes the ‘approval’ of all requests – there is no electronic return acknowledgement... and any discrepancies must be adjusted manually via A/R Debit Memos or Cash Receipts.

In a two-way scenario, upon the return from the Bank (most often of just the 'denials'), a negative-entry is made to Cash Receipts (or to the Batch if it has not yet been internally posted to Accounts Receivable).

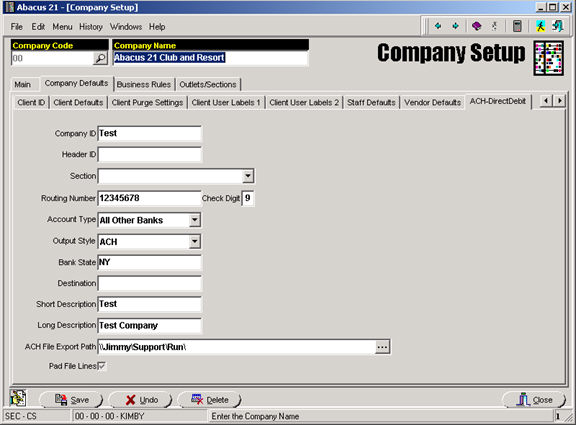

Header ID –

Section: Not required.

Routing Number: This is the Bank Routing Number for the Company's Bank Account. The first eight digits of the Routing Number should be entered.

Check Digit: This is the last number of the Routing Number.

Account Type:

Output Style:

Bank State: Enter the State where the Bank is located.

Destination:

Short Description: User defined. This should be something identifying the Company. (eg. Abacus 21)

Long Description: User defined. This should be something identifying the Company. (i.e. – Abacus 21 ACH Payments)

ACH File Export Path: This is the full DOS path where the file will be exported.

It is important that this path be different for each Company being processed in order to keep the files for the different Companies separate.

Pad File Lines:

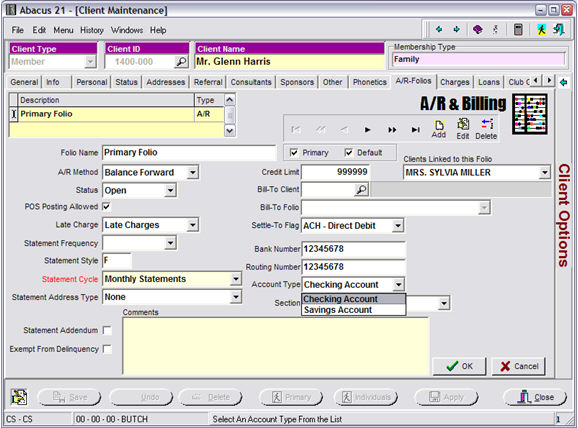

Settle-To Flag: Set to ACH - Direct Debit

Bank Number: Enter the Client’s Bank Account nNmber.

Routing Number: Enter the Routing Number for the Client’s Bank.

Account Type: Checking or Savings.

Section: not required.

The ACH program will process the full amount owed on a Statement for the dates indicated... and will create a file that will be exported to the directory set up in Company Maintenance. The file name will be:

“DATE”.txt.

The Operator must then run software provided by the Bank to send the file to the Bank for processing; see your respective Bank.

The ACH program then creates a Batch in Cash Receipts Entry. The Operator must then run a Cash Receipts Journal to post the (assumed) Payments to the Client A/R Accounts.

Note: It is assumed that all payments will be approved -- see below.

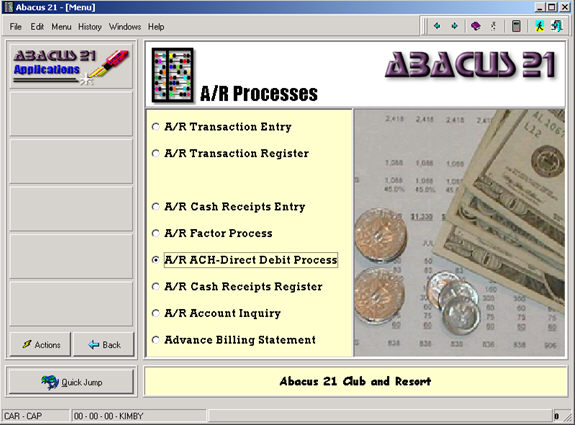

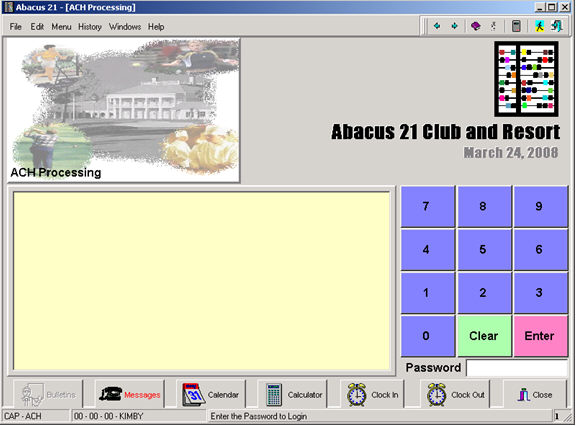

At Password, sign into the ACH Processing Application (a Staff Privilege is required).

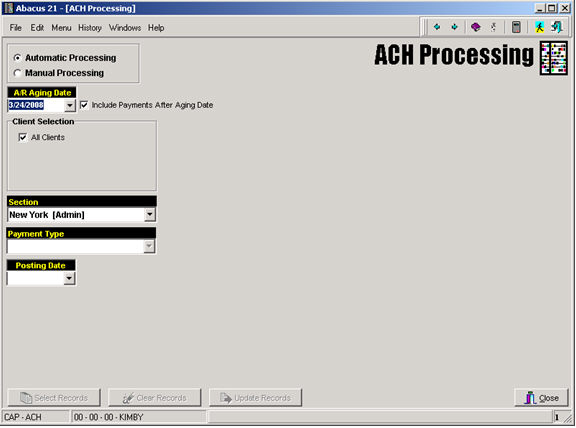

Automatic Processing –

A/R Aging Date: Enter the Date you are processing (usually current Date). This will be the Date on the Member-Client Statement.

Include Payments After Aging Date: Click if 'Yes'.

Client Selection: Select Clients to be included.... the Automatic Option assumes 'All'.

Section: Select the A/R Section

Payment Type: This will be the same Payment Type Code currently used in Cash Receipts Entry.

Posting Date: Select the Date to be used as the 'Posting Date'.

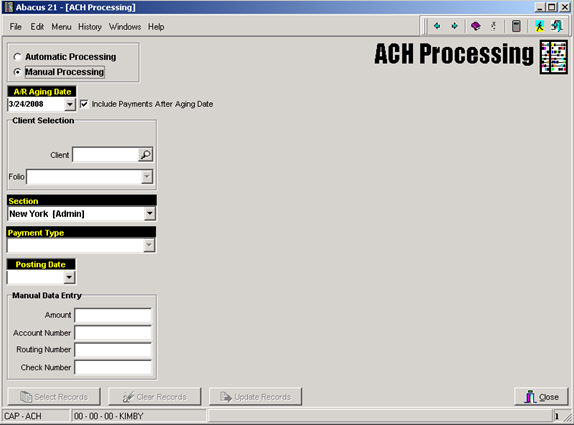

Manual Processing -

A/R Aging Date: Enter the Date you are processing (usually current Date). This will be the Date on the Member-Client Statement.

Include Payments After Aging Date: Click if 'Yes'.

Client Selection (and perhaps Folio within Client-A/R):

Section: Select the appropriate Section.

Payment Type: This will be the same Payment Type Code currently used in Cash Receipts Entry.

Posting Date: Select the Date to be used as the 'Posting Date'.

Amount: Enter the Amount to be ACH'd for this Client

Account Number: Enter the Client's Bank Account Number

Routing Number: Enter the Bank's Routing Number.

Check Number: Enter the Client's Check Number.

_________________________________

Regarding the ACH output directory, if the setup for an Output directory is in a central location (in the Database rather than in the .ini), then it is a better practice to have that directory be in a universally accessible location on the Server.